Scaling Portfolio Companies Faster: Custom Software Solutions For Venture Capital Firms

Did you know that timing accounts for 42% of the variance between success and failure in startups? Managing venture capital portfolio management software effectively has become crucial due to the high failure rate of early-stage companies. We’ve seen firsthand how VC firms struggle with the challenge of transforming raw data into real-time insights that drive smarter investment decisions.

In today’s competitive landscape, managing diverse portfolios across multiple industries, tracking investment performance, and ensuring seamless communication with LPs demand more than just spreadsheets and disconnected tools. Venture capital success hinges on effective portfolio management, which assists in risk-reward balancing and strategy optimization. Without consistently monitoring key metrics, firms struggle to assess whether their investments are on track to deliver the desired returns.

At CyberMedics, we’ve worked with numerous venture capital firms facing these exact challenges. The solution isn’t simply adopting generic software—it’s implementing custom portfolio management solutions tailored specifically to your investment strategy and operational needs. This article explores how custom software solutions can accelerate scaling and value creation in your portfolio companies, providing a competitive edge through improved operational performance, data reporting, scalability, and ultimately, enhanced exit valuation.

Why Off-the-Shelf Tools Fail in Portfolio Company Environments

Off-the-shelf investment tools often dazzle in demos but quickly reveal their limitations once implemented—particularly for venture capital firms managing diverse portfolio companies. The promise of ready-made solutions rapidly fades when confronting the complex realities of high-growth environments.

Lack of integration with unique workflows and systems

The fundamental problem lies in rigidity. Generic portfolio management tools are designed for the broadest possible audience, forcing venture capital firms to conform to the software’s processes—not the other way around. Custom capital call workflows, unique fund structures, and cross-border tax requirements frequently remain unaddressed by standardized solutions.

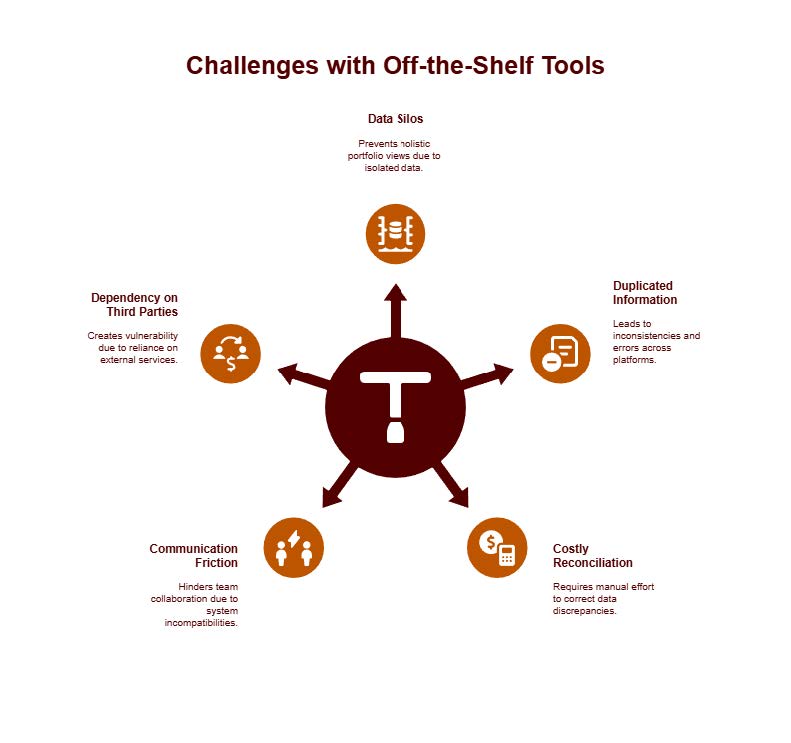

Integration challenges create particularly severe headaches for investment firms. Your ecosystem likely includes CRM systems, analytics platforms, and document repositories. Unfortunately, off-the-shelf tools frequently fail to integrate effectively with these existing systems, resulting in:

- Data silos that prevent holistic portfolio views

- Duplicated information across platforms

- Costly manual reconciliation processes

- Increased communication friction between teams

Furthermore, integration isn’t merely a technical challenge—it’s a business partnership. When integrating with third-party organizations, you become dependent on their service delivery, creating vulnerability if they’re acquired or discontinue support. This dependency can prove catastrophic when the integration sits at the heart of your investment operations.

Scalability issues in high-growth startup environments

PwC predicts assets under management will grow from $84.90 trillion in 2016 to $145.40 trillion by 2025. Despite this growth trajectory, many investment firms aren’t scaling their processes or infrastructure accordingly. Generic software solutions frequently become bottlenecks rather than accelerators.

Scaling challenges manifest in multiple ways:

First, off-the-shelf products typically control their own development roadmaps. Feature requests enter lengthy queues, and your ability to innovate becomes constrained by someone else’s priorities. Meanwhile, your portfolio companies face rapidly evolving markets demanding immediate adaptability.

Second, as your firm grows, the limitations of inflexible software become increasingly apparent. What initially seemed adequate for managing a handful of investments becomes problematic when tracking dozens of companies across varied sectors with different metrics and reporting needs.

Notably, research shows that 74% of high-growth internet startups fail due to premature scaling. Without software that can adapt to changing requirements, your portfolio companies risk joining this statistic.

Manual workarounds increase operational risk and cost Manual workarounds increase operational risk and cost

Faced with inflexible tools, many venture capital firms resort to manual workarounds. Family offices and investment firms are particularly prone to implementing quick fixes because they typically operate with lean teams focused on wealth management rather than technology.

These workarounds create substantial long-term consequences:

Initially, they might address immediate needs through manual steps or isolated solutions to bypass system limitations. Over time, however, these shortcuts lead to data inconsistencies, redundant information, and human error that erode data integrity.

Manual processes also substantially increase operational risk. Research shows that 60-70% of work that relationship managers perform isn’t advisory at all but rather administrative tasks susceptible to human error. Additionally, these workarounds typically rely on a single person understanding all the interconnections—creating dangerous vulnerabilities if that individual leaves.

Consequently, operational inefficiency grows. Automation tools can save investment professionals 2-3 hours daily, but this potential remains unrealized when relying on spreadsheets and disconnected systems. Instead, team members waste valuable time on low-value data entry and reconciliation tasks.

For venture capital firms, the implications extend beyond internal operations to portfolio company performance. Without integrated systems providing real-time visibility, decision-making suffers from incomplete or outdated information—directly impacting portfolio value and eventual exit multiples.

The Case for Custom Software in Venture Capital Portfolio Management

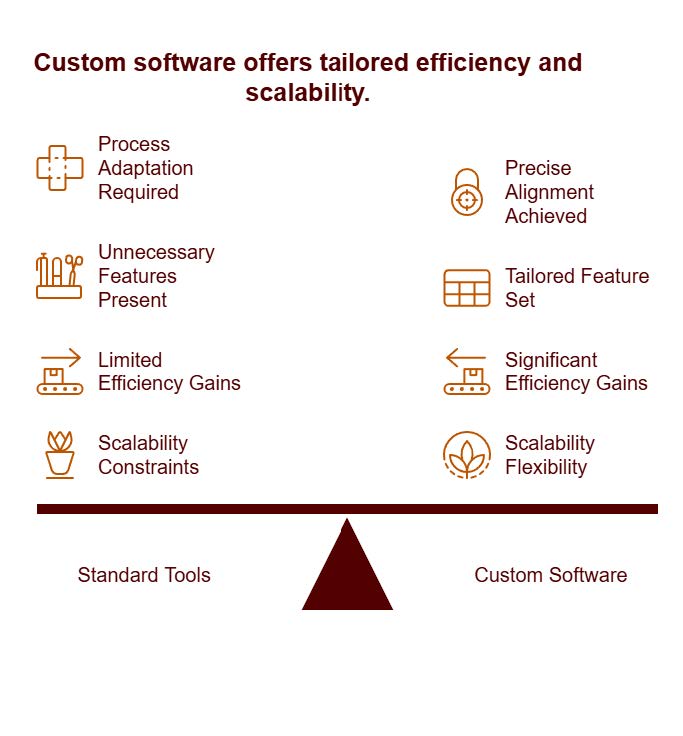

Custom software development creates a competitive advantage for venture capital firms seeking to outperform industry benchmarks. Unlike generic alternatives, tailored solutions directly address the unique operational challenges of portfolio management while supporting long-term growth objectives.

Custom solutions tailored to portfolio company business models

Standard portfolio management tools often force VCs to adapt their processes to fit software limitations. In contrast, custom software aligns precisely with your investment approach and portfolio company requirements. This alignment eliminates unnecessary features while incorporating exactly what your team needs to drive performance.

The custom software industry reached USD 35.42 billion in 2023 and continues growing at 22.5% annually through 2030. This growth reflects the increasing recognition that tailored solutions deliver significant advantages in specialized environments like venture capital.

Firms implementing custom software report up to 25% improvement in operational efficiency and substantial cost reductions in repetitive tasks. These efficiencies translate directly to portfolio company performance through:

- Automated IRR and MOIC calculations across investment stages

- Real-time visualization of ownership structures and cap tables

- Customized KPI tracking tailored to each portfolio company’s business model

- Secure document management with industry-specific compliance controls

As startups in your portfolio grow, custom software scales alongside them, adapting to evolving requirements without the constraints generic tools impose. This flexibility proves essential as portfolio companies navigate different growth stages with changing operational priorities.

Integration with Microsoft 365, Power Apps, and Azure

Microsoft’s enterprise framework provides a powerful foundation for custom portfolio management solutions. By leveraging Microsoft Dynamics and Azure, we create secure, scalable platforms that seamlessly connect with your existing ecosystem.

Integration capabilities extend beyond basic compatibility to include:

- Direct access to Microsoft 365 data including mail, calendars, contacts, users, groups, files, and folders

- Custom app registrations at the Microsoft Entra ID admin level, making applications available enterprise-wide

- Azure Communication Services that enable secure, compliant communications between portfolio companies and your team

- Multi-layered security stacks across physical datacenters, infrastructure, and operations

These integrations eliminate data silos while maintaining SOC1 and SOC2 compliance standards essential for venture capital operations. Moreover, since many portfolio companies already use Microsoft tools, integration reduces adoption friction and accelerates time-to-value.

CyberProcess™: Design → Develop → Deliver → Impact

At CyberMedics, our CyberProcess™ methodology transforms business requirements into measurable outcomes through a structured approach:

Design: We begin by identifying specific operational challenges and mapping how custom software will address them. This phase establishes clear success metrics tied to portfolio performance.

Develop: Our development process creates solutions that integrate seamlessly with existing systems while incorporating cutting-edge technologies like AI and machine learning where appropriate.

Deliver: Implementation includes comprehensive testing, user training, and deployment strategies designed to minimize disruption while maximizing adoption.

Impact: We measure success through tangible business outcomes – faster scaling, improved reporting accuracy, and ultimately higher exit valuations for portfolio companies.

Generic tools weren’t built for your portfolio’s growth strategy — but we are. If you’re looking to eliminate inefficiencies, streamline reporting, and prepare companies for scale, let’s design the right solution. [Contact CyberMedics to start the conversation →]

Companies implementing custom software benefit from control over updates and adaptations as business requirements evolve. This control proves especially valuable in venture capital, where portfolio companies operate in rapidly changing markets requiring agile responses to new opportunities.

Unlike pre-packaged solutions, custom software delivers long-term value despite higher initial investment, primarily through increased efficiency, lower maintenance costs, and superior alignment with business objectives.

Key Features of Custom Portfolio Management Software for VCs

Effective portfolio management relies on specific technical capabilities that give venture capital firms crucial operational advantages. Custom software solutions offer features specifically designed for VC workflows that generic alternatives simply cannot match.

Real-time KPI dashboards for board and LP reporting

Data visibility directly impacts investment outcomes. By integrating with portfolio companies’ CRM and sales systems (like Salesforce or HubSpot), custom dashboards deliver live metrics without waiting for monthly reports. This real-time integration transforms static reports into dynamic visualizations that update continuously with the latest performance data.

These dashboards primarily serve two critical functions: providing partners with instantaneous portfolio visibility and enabling transparent LP communication. Through customizable views, different stakeholders access precisely the information they need—executives see fund-level performance, whereas operating partners monitor company-specific metrics.

Automated IRR and MOIC tracking across portfolio

Performance measurement remains fundamental to VC operations. Internal Rate of Return (IRR) represents the annualized effective compounded return rate that makes the net present value of all cash flows equal to zero. Meanwhile, Multiple on Invested Capital (MOIC) shows the ratio of total value returned to investors divided by total capital invested, providing a straightforward view of created value per dollar.

Custom software automates these complex calculations across your entire portfolio, subsequently eliminating error-prone manual processes. This automation enables consistent tracking of both realized and unrealized gains using preferred cost methods like weighted average cost of capital (WACC).

Ownership structure and cap table simulation tools

As portfolio companies evolve through funding rounds, ownership structures become increasingly complex. Custom cap table management tools provide instant visibility into current ownership percentages across stakeholder groups along with historical transaction records.

Advanced scenario modeling has become essential for VC decision-making. These tools allow you to simulate proposed investment terms before closing deals, visualizing changes in ownership percentages under different investment conditions. This capability proves particularly valuable when projecting stakes through several financing rounds.

Secure document storage and audit-ready reporting

Information security represents a non-negotiable requirement for venture firms. Leading solutions offer state-of-the-art encryption, customizable access controls, and document expiration settings that protect sensitive information.

Custom reporting tools generate audit-ready documentation for 409A valuations, GAAP/IFRS reporting, and tax forms like 83(b) and Form 3921. These capabilities ensure regulatory compliance while simplifying due diligence processes during exits.

By implementing these custom features, VCs gain both tactical advantages in daily operations and strategic benefits through enhanced portfolio company performance.

Strategic Benefits for VC Firms and Operating Partners

For venture capital firms, investing in custom software solutions yields far more than technical advantages—it drives measurable business outcomes across your entire portfolio. The strategic impact extends beyond individual companies to enhance overall fund performance.

Faster scaling of portfolio companies through operational efficiency

Custom software directly accelerates portfolio company growth through process automation and operational streamlining. Firms implementing automation technology report reducing operational costs by up to 30%, freeing capital for market expansion. Through enhanced efficiency, companies experience 25-50% increases in process efficiency after automating workflows.

This efficiency translates to practical outcomes:

First, operating partners can reallocate resources from administrative tasks to strategic initiatives. Research shows investment professionals save 2-3 hours daily through proper automation, enabling more focused portfolio support.

Second, custom solutions eliminate bottlenecks that typically constrain growth. As portfolio companies scale, their operational needs evolve rapidly—custom software adapts alongside them, preventing the limitations that generic tools impose when companies reach critical growth phases.

Improved decision-making with centralized data visibility

Centralized data repositories transform how venture firms manage investments and support portfolio companies. According to a Juniper Square survey, “portfolio monitoring” has become the #1 area for technology investment in venture capital, with 53% of firms prioritizing improved portfolio data management.

This visibility delivers several competitive advantages:

With proprietary data well-organized, firms build robust benchmarks that drive investment discipline and improve asset allocation decisions. Real-time access to portfolio metrics enables early detection of both outperformers deserving additional capital and struggling companies requiring intervention—often before problems become terminal.

For operating partners, this translates to more productive engagement with portfolio companies. Rather than debating data accuracy, conversations shift toward strategic action based on shared insights.

Higher exit multiples through operational maturity and reporting readiness

Operational maturity directly influences exit valuations. According to a 2023 McKinsey study, firms with proven value creation methodologies raised capital 30% faster. Similarly, Bain reported GPs using technology to demonstrate value creation saw a 25% increase in LP commitments.

This advantage becomes particularly valuable during exit preparation. Custom solutions ensure audit-ready reporting and transparent performance tracking—elements that simplify due diligence and build buyer confidence. Throughout the investment lifecycle, comprehensive reporting capabilities demonstrate governance structures that mitigate risk concerns, thereby attracting higher-quality buyers willing to pay premium multiples.

When and How to Implement Custom Software in Your Portfolio

Determining the optimal moment for custom software investment remains a critical decision point for venture capital firms. The transition from spreadsheets to sophisticated portfolio management solutions requires thoughtful planning and execution.

Identifying the right stage for software investment

First and foremost, evaluate your portfolio companies’ readiness based on operational complexity and growth trajectory. The ideal implementation window typically occurs when manual processes begin creating bottlenecks—often as you scale beyond your third or fourth fund with 50-100 portfolio companies under management. Before this point, tracking data in spreadsheets might suffice; beyond it, sophisticated solutions become essential.

Ask yourself: “What is the minimum amount of features needed to make an impact?” Much like portfolio companies, VCs often overcomplicate requirements, focusing on too many features without sufficient depth in critical areas.

Collaborating with COOs and CTOs for implementation

Successful implementation demands cross-functional collaboration. Engage with portfolio company operations leaders early to understand their unique workflows and pain points. This discovery phase should involve deep conversations with founders, management teams, and operational personnel to identify efficiency opportunities.

Work closely with technology leadership to align the platform with investment strategies and objectives. As one CIO notes, “We’ve become more agile, responding quickly to market changes and customer needs” through collaborative implementation approaches.

Measuring ROI: Time-to-scale and cost savings benchmarks

Track quantifiable metrics before and after implementation to demonstrate value. Key performance indicators include:

- Revenue increases or new revenue streams generated

- Cost reductions through automation and process improvements

- Productivity gains measured in time saved

- User adoption rates and satisfaction

For calculating ROI, use the formula: (Gain from Investment – Cost of Investment) / Cost of Investment. This straightforward approach helps justify further development and communicate value to stakeholders.

Conclusion

Throughout this article, we’ve examined why traditional off-the-shelf software fails venture capital firms and their portfolio companies. Generic solutions simply cannot address the complex, unique workflows that characterize high-growth environments. Consequently, VCs find themselves trapped in inefficient processes, data silos, and manual workarounds that ultimately limit portfolio company performance.

Custom software solutions offer a fundamentally different approach. Rather than forcing your investment strategy to conform to predefined parameters, tailored solutions adapt precisely to your operational needs. This alignment enables portfolio companies to scale faster while maintaining operational discipline. Additionally, the real-time dashboards, automated performance tracking, and seamless integration capabilities provide the visibility necessary for data-driven decision making at critical investment junctures.

The impact extends well beyond day-to-day efficiency. VCs implementing custom portfolio management solutions report substantial improvements across key metrics – from operational cost reductions to accelerated growth trajectories. These gains translate directly to what matters most: higher valuations at exit. Portfolio companies with mature operational systems and transparent reporting undergo smoother due diligence processes, therefore commanding premium multiples from acquirers.

Our CyberProcess™ methodology ensures these benefits materialize through a structured approach focused on measurable outcomes. We start by understanding your specific challenges, develop solutions that integrate with existing systems, and deliver implementations that drive adoption. Generic tools weren’t built for your portfolio’s growth strategy — but we are. If you’re looking to eliminate inefficiencies, streamline reporting, and prepare companies for scale, let’s design the right solution. [Contact CyberMedics to start the conversation →]

The competitive landscape for venture capital continues to intensify. Firms that gain operational advantages through custom software position themselves to outperform industry benchmarks consistently. Your portfolio companies deserve technology solutions as ambitious and forward-thinking as their business models. The right custom software doesn’t just solve today’s challenges—it creates tomorrow’s opportunities.