Private Equity’s New Reality: Financial Capital Meets AI Risk Assessment

Private equity fund managers are keeping their investments longer than ever, with 84% reporting extended holding periods. More than 4,000 U.S. companies have stayed in portfolios for over five years, waiting to exit. This new reality comes at a time when technology has changed how investment decisions are made.

AI is becoming the new compass in this quickly evolving investment landscape. With 95% of venture capital and private equity firms using AI-driven systems, traditional risk assessment is being enhanced, or even replaced, by algorithmic insight. But this rapid adoption is not without turbulence. Over half of U.S. and Canadian firms expect regulatory headwinds on AI within the next 12–18 months. Still, with AI driving more than 40% of this year’s U.S. GDP growth, firms can’t afford to ignore it. The challenge? Better tools for risk navigation. Many buyers are already walking away from deals based on AI findings—proof that in today’s market, data-driven decisions are no longer optional, they’re directional.

AI in Deal Sourcing and Initial Risk Screening

Private equity firms are changing how they source deals through AI-powered systems. These systems analyze and interpret data at a scale never seen before. Top PE firms are also using their own AI sourcing engines to screen potential investments. These engines often spot patterns that human analysts might miss and keep improving their algorithms with new data.

How AI identifies hidden opportunities in private markets

Private markets have always been a black box for investors. They are fragmented, opaque, and hard to navigate. AI breaks these barriers by helping firms to:

- Search through huge sets of data like financial filings, industry reports, news articles, and social media to find businesses that match specific criteria

- Spot early market signals and emerging trends before they become common knowledge

- Figure out which businesses might need funding at specific times

This change shows real results. Users of AI platforms report finding 2-6 times more deals. They see 10-20% better returns and 30% better efficiency. Most importantly, these firms are first to reach deals 70% of the time.

Reducing bias and improving early-stage risk filters

Machine learning makes early-stage screening better. Research shows that LLM agents work 537 times faster than human VC analysts while maintaining the same quality in categorizing opportunities. On top of that, AI governance keeps datasets accurate, complete, current, and unbiased. However, without proper checks, AI can make existing biases worse by filtering opportunities based on flawed historical data.

Custom workflow automation for deal qualification

AI makes the qualification process smoother through automated document management that organizes and reviews deal-related files and pulls key insights from financial records and due diligence reports. These AI systems can spot bottlenecks, predict when delays might happen, and suggest next steps to keep deals moving.

PE firms now understand they need to balance AI’s possibilities with practical reality. The best implementations focus on proven use cases that show EBITDA impact within six months or less. This approach moves beyond wishful thinking to create real value.

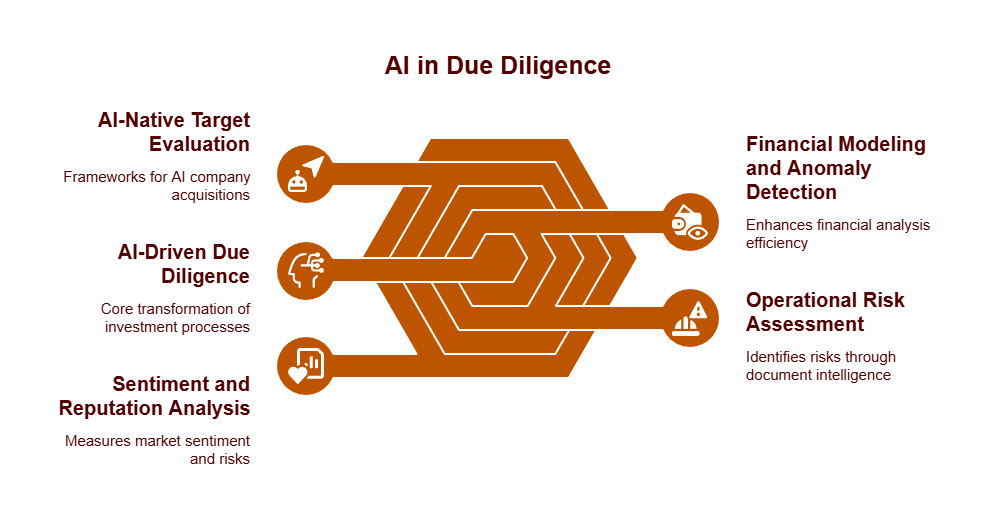

Transforming Due Diligence with AI

AI has revolutionized due diligence, which was once the most time-consuming part of private equity investment.

Automated financial modeling and anomaly detection

AI has transformed financial modeling efficiency. Teams can now:

- Process financial records spanning years within minutes instead of weeks

- Reduce modeling time by up to 70%

- Spot trends, inconsistencies, and growth opportunities with unmatched precision

The traditional analyst workflow has flipped completely. Instead of spending 90% of time on numbers and 10% on judgment, the ratio has reversed. AI algorithms detect anomalies fast and highlight unusual transactions or accounting practices that need investigation. This reduces human error and leads to better decisions.

Operational risk assessment through document intelligence

Natural Language Processing technology quickly scans thousands of documents and finds key clauses and obligations that could affect deal value. Document intelligence looks at workforce data to check talent retention risks and company culture through internal communications. These systems can measure target companies against industry standards using live data from multiple sources.

Evaluating AI-native targets: new diligence frameworks

Standard evaluation methods don’t work well for AI-native acquisitions. Today’s investors need special frameworks to test:

- Model risk and data rights

- Infrastructure cost sensitivity

- Evaluation reproducibility

- Per-request unit economics

Deals should pause when there’s no data rights on training sources, accuracy claims lack reproducible evaluation tools, or there’s heavy reliance on one provider without a backup plan.

Sentiment and reputation analysis using NLP

NLP algorithms scan billions of web articles for positive and negative language and measure emotions like fear and anticipation. These metrics flag sentiment changes and spot reputation risks that could affect portfolio value. Industry leaders say this capability is crucial as AI tools analyze competitive positions by processing market data and tracking consumer sentiment on social media platforms.

Portfolio Oversight and Compliance in the AI Era

PE fund managers face mounting pressure from longer holding periods. They must oversee growing portfolios while finding new ways to create value. All the same, about 63% of general partners still depend on manual data management through spreadsheets. This creates major blind spots that slow down performance tracking and risk detection.

Real-time monitoring and predictive alerts

AI-powered systems keep constant watch over portfolios. Fund managers can spot patterns—from performance warnings to similarities between portcos—and get immediate recommendations. About 60% of PE managers now use AI tools that give early warnings. These tools help them catch problems like falling margins or supply chain delays before they grow worse. The predictive models can show what might happen during market changes, supply disruptions, or compliance issues. This lets managers plan ahead more effectively.

Standardizing reporting across portcos

Portfolio companies often use their own reporting formats. PE fund managers must settle large amounts of data by hand. A standard system creates one source of truth for all portfolio companies. This gives better transparency, consistent measurements, and quicker decisions. AI helps make quarterly and annual report formats uniform. Managers can then analyze data, learn more, and find trends faster.

Microsoft Power Platform for compliance automation

The Power Platform has tools—Power Apps, Power BI, and Power Automate—that help everyone access business intelligence and automation easily. These tools watch compliance needs closely. The admin center’s audit features provide complete logs of admin, maker, and user activity. This plays a vital role in spotting possible security threats.

AI in investor relations and LP reporting

AI helps fund managers adjust their communications for each investor or LP. It studies past investor communications and meetings to show what investors care about most. The system can also sum up board packs, write performance stories, point out what’s changing, and suggest investor-ready content based on the data.

Exit Strategy and Long-Term Value Creation

Private equity investors aim for strategic exits as their ultimate goal. Recent data shows that firms using advanced analytics in their exit strategies perform 20% better than their peers in realized returns.

AI-driven exit timing and buyer matching

AI reshapes exit timing decisions through analysis of big datasets that include historical transactions, market trends, and economic indicators. This analytical approach helps fund managers:

- Get maximum returns through optimal exit timing

- Set up AI-powered alerts that detect market condition changes

- Spot opportunities when strategic buyers have cash and want to acquire

AI expands the potential acquirer pool by matching buyers based on industry trends, deal history, and preferred structures. These systems build and update buyer profiles based on recent activity. Fund managers can maximize valuations and improve their outreach efforts.

Using AI to forecast market appetite and valuation trends

Predictive analytics help simulate different exit scenarios—trade sales, IPOs, or secondary buyouts—and evaluate potential returns from each using live data. This helps investors better understand when they’ll see returns and their worth. For example: a $500 million fund can generate millions in additional returns through earlier reinvestment opportunities by exiting just one quarter sooner.

Making digital transformation ready for exit

Digital transformation stands as a key part of the value creation agenda. Assets with strong AI investments need their commercial performance, technology, and intellectual property to match buyer expectations.

Commercial elements like AI maturity and market differentiation lead the list of exit-critical factors. About 57% of respondents say AI maturity plays a crucial role in successful exits.

Conclusion

Private equity now faces a turning point where financial capital meets AI-based risk assessment. The industry deals with longer holding periods while new technologies reshape investment approaches. PE firms must now balance AI’s huge potential with growing governance concerns.

AI tools prove their worth throughout the investment lifecycle. These technologies help uncover hidden deals and flag key risks during due diligence. The results speak for themselves – firms that use these tools find more deals and get better returns. They also make decisions faster than rivals who stick to old methods.

On top of that, portfolio management works better with up-to-the-minute monitoring that spots problems early. Many general partners still use manual processes. Yet those who switch to AI-powered platforms with standard reporting gain a clear edge through better transparency and quicker decisions.

Data-driven methods have changed how exits work too. PE firms now use advanced analytics to process market data quickly. This helps them pick the right time to exit, find ideal buyers, and prepare digital systems for sale.

Success in private equity no longer depends just on having capital. Firms need smart tech-based risk assessment throughout their investment cycle. Those who adapt to this new reality will outperform their peers in coming years. Those who resist change risk falling behind in our tech-driven financial world.

PE firms that succeed will strike the right balance between tech advances and solid investment principles. They’ll use AI to boost human judgment, not replace it.

At CyberMedics, we partner with private equity teams to operationalize these capabilities through custom-built automation systems, compliance solutions, and workflow optimization. Our platforms turn fragmented, manual processes into integrated, auditable, and scalable systems—built for the complexities of AI-era investing.

Schedule a consultation with CyberMedics and discover how we bring clarity, control, and confidence to AI-driven investment strategies.