Why Private Equity Firms Lose Millions Through Fragmented Data Analytics

At CyberMedics, we’ve observed firsthand how disparate financial, operational, and customer data systems create fragmentation that slows decision-making and limits strategic oversight. In fact, research indicates organizations can incur over 15% in potential annual losses directly attributable to poor data access and quality. Private equity firms, though acting as elite personal trainers for businesses, often find themselves hobbled by their own inefficient data ecosystems. Without centralized access to financial data organized to match fund entities, they frequently depend on analyst teams and fund administrators to provide and reconcile information upon receipt.

This article examines why fragmented data costs PE firms millions, how it impacts key functions across portfolio companies, and presents our proven approach to solving these challenges through centralized data systems and unified analytics.

The Hidden Cost of Fragmented Data in Private Equity

Private equity firms lose millions annually due to fragmented data systems across their portfolios. Research indicates organizations can incur over 15% in potential annual losses directly attributable to poor data access and quality. These costs manifest in concrete ways that directly impact returns and operational effectiveness.

Missed Opportunities in Deal Sourcing and Valuation

Finding suitable deals requires extensive research into potential targets, yet fragmented data creates substantial roadblocks. Over 80 opportunities need to be sourced just to finally invest in one single deal, making efficient data management crucial. Furthermore, the scattering of crucial information across PDFs, spreadsheets, and CRMs in both structured and unstructured formats creates massive operational challenges during due diligence. Consequently, 70%-90% of M&A deals fail to meet expectations, often due to flawed due diligence.

Operational Inefficiencies Across Portfolio Companies

As PE portfolios grow through acquisition, each portfolio company typically operates its own financial systems, charts of accounts, and reporting structures. This creates redundant licensing costs that directly impact EBITDA. Additionally, finance teams spend countless hours extracting, transforming, and manually consolidating data from disparate systems. Without centralized access to financial data organized to match fund entities and vintages, firms often depend on analyst teams and fund administrators to provide and reconcile information upon receipt. This extensive time spent on data hygiene and reconciliation means less time producing impactful, high-quality analysis for deal teams and investors.

Delayed Decision-Making Due to Inconsistent Metrics

Perhaps most costly is the impact on strategic decision-making. Capital calls are missed or delayed, and investment reviews remain incomplete with performance data scattered across spreadsheets, PDFs, and emails. Without real-time visibility into committed or uncalled capital, strategic decisions become reactive. Most systems cannot provide a current view of what’s been committed, what’s uncalled, and what’s been distributed across funds. At the same time, IRR and TWR figures often become outdated, creating a situation where reports arrive after decisions are made. This lag in information flow leads to missed opportunities and delayed responses to emerging risks.

How Fragmented Data Impacts Key Private Equity Functions

Fragmented data creates specific operational challenges across critical private equity functions, costing firms both time and money. Research shows that these inefficiencies manifest in four key areas that directly impact profitability.

Manual Reconciliation in Finance and Fund Accounting

Finance teams struggle with limited data accessibility, frequently depending on analyst teams and fund administrators to provide information that requires painstaking line-by-line reconciliation upon receipt. This extensive time spent on data hygiene means less time producing impactful analysis for deal teams and investors. The process is notably error-prone—nearly one-third of financial services organizations consider mistakes from manual processes their biggest data reconciliation challenge. Moreover, in-house teams often spend four to five hours completing daily reconciliations, creating a substantial productivity drain.

Investor Relations Bottlenecks from Inaccessible Data

Investor relations teams face mounting pressure as investors become more sophisticated, asking rapid-fire, in-depth questions about precise performance indicators and fund-level cash flows. Nevertheless, much of this information isn’t readily accessible, requiring multiple follow-ups that add to operational backlogs. Subsequently, 72% of asset managers cite data quality as a top concern. Many struggle with slow manual reporting processes that create delays in both routine and quarterly reports, while inconsistent data makes investor meetings and decision-making more challenging.

Compliance Risks from Disparate Reporting Systems

Historically, PE firms managed data using a patchwork of manual processes, spreadsheets, and fragmented systems. Although spreadsheet-based operations provide flexibility, they are notoriously error-prone and can require managers to “move mountains” to respond to regulatory exam inquiries. Inadequate books and records documentation frequently results in deficiencies—and even fines—when investment advisers fail to meet record-keeping requirements. Missing deadlines for distributing audited financials and other mandatory notices likewise leads to significant regulatory actions.

Inconsistent KPIs in Multi-Entity Portfolio Management

Each private asset class has unique requirements, making data aggregation increasingly complex. Throughout private equity portfolios, high levels of fragmentation across internal operational systems impact investor experience. Although PE investments in accounting and related services firms reached $6.31 billion in 2024—the highest level since at least 2015—consolidating performance data remains challenging when portfolio companies operate disparate systems with different reporting structures.

The Case for Centralized Private Equity Data Systems

Centralizing data systems offers private equity firms a strategic advantage that directly addresses fragmentation challenges. Integrated solutions produce measurable improvements in operational efficiency and decision-making capabilities.

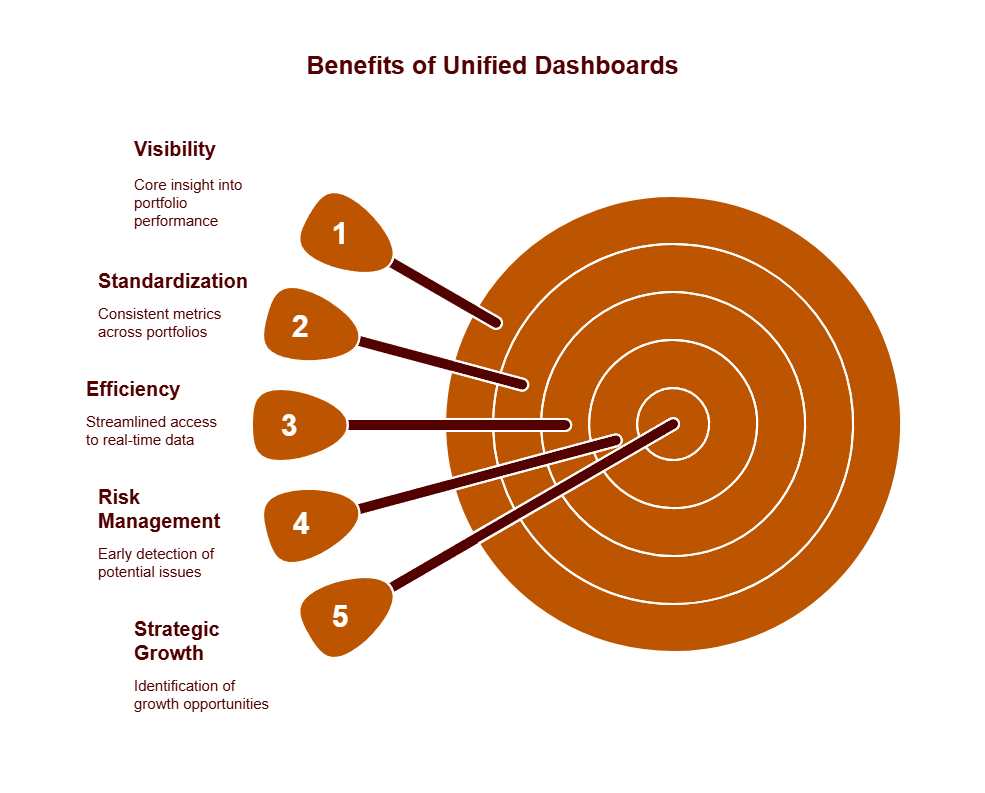

Benefits of Unified Dashboards for Portfolio Monitoring

Unified dashboards deliver crucial visibility into portfolio performance, eliminating delays in tracking KPIs and trends.

These centralized platforms standardize metrics across portfolio companies, enabling consistent board updates and meaningful cross-portfolio benchmarking. Rather than wrestling with disparate systems, portfolio managers gain access to real-time data through a single source of truth. Indeed, consolidated dashboards allow firms to identify risks and growth opportunities across their portfolios, flagging issues like spikes in churn rates instantly.

Real-Time Alerts and Predictive Analytics in Investment Management

Beyond historical reporting, centralized systems offer forward-looking capabilities through predictive analytics. The market for predictive analytics is projected to grow at a compound annual rate of 34% through 2027. These tools monitor both external and internal portfolio data to deliver real-time alerts for emerging risks and opportunities. Furthermore, AI-enabled analytics tools can reduce manual workloads by up to 35%, accelerate compliance cycles by 20-30%, and lower operational costs by up to 25%.

Improved Audit Readiness and Regulatory Compliance

Centralized systems drastically improve compliance capabilities. Considering non-compliance costs are 2.71 times higher than compliance costs, this represents significant savings. Standardized reporting aligns with Institutional Limited Partners Association (ILPA) guidelines, helping firms cut audit preparation time and enhance investor trust. Accordingly, proactive monitoring through these systems minimizes compliance failures by 15-20%.

Cross-Entity Visibility for Strategic Capital Allocation

One of the fastest ways to reduce portfolio-wide IT spend is centralizing vendor management. PE firms that consolidate vendors report up to 30% cost savings across their portfolios. This approach doesn’t mean forcing identical platforms—instead, it creates a shared infrastructure that accelerates performance. Key benefits include faster M&A integration, lower costs via bulk licensing, and enhanced exit readiness.

Solving Data Fragmentation with The CyberProcess™

The CyberProcess™ methodology offers a structured approach to eliminating data silos across private equity portfolios. Through a four-phase framework, we transform fragmented systems into unified analytics platforms that deliver measurable value.

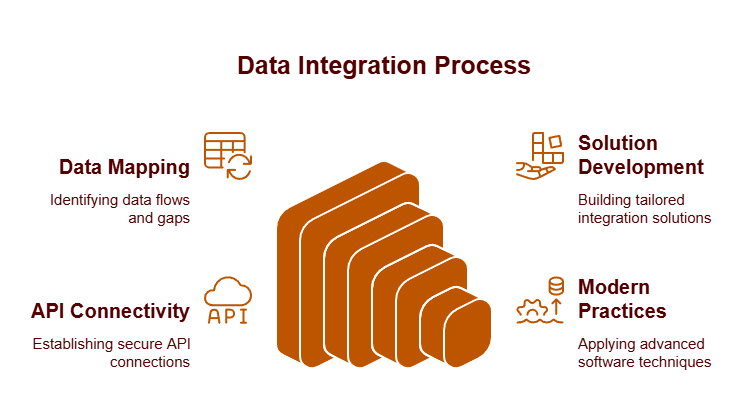

Design Phase: Mapping Data Flows and Identifying Gaps

Our process begins with a comprehensive assessment of your current data landscape. First, we analyze how information moves across disparate systems and identify bottlenecks causing inefficiencies. Through deep understanding of private equity data complexities, we prioritize integration needs based on business impact versus implementation effort.

Develop Phase: Custom Software Development for Integration

Once we’ve mapped your data ecosystem, our experienced development team builds tailored solutions that connect fragmented systems.

We employ advanced data mapping techniques and select the right integration architecture for your specific requirements. Our approach incorporates API-driven connectivity and modern software development practices that ensure security while maximizing flexibility.

Deliver Phase: Workflow Automation and Business Intelligence

The deliver phase focuses on automating manual processes and implementing business intelligence tools. Automated workflows reduce bottlenecks between teams, empowering stakeholders with information they need to make decisions faster. Our BI solutions provide unified dashboards that consolidate metrics from various portfolio companies, offering real-time insights across your investments.

Impact Phase: Real-World Results from Approval Tracking Systems

Implementation of approval tracking systems has yielded impressive outcomes for PE firms. These systems streamline document collection, automate validation checks, and create auditable data trails. In fact, AI-powered workflow automation can reduce manual workloads by up to 35% while accelerating compliance cycles by 20-30%.

Case Study: Materials Management System for Operational Efficiency

Data inconsistencies hamper efficient inventory management across portfolio companies. Only 39% of organizations report full data uniformity across all materials. Our materials management system solved these challenges by standardizing data formats, centralizing inventory control, and implementing predictive analytics for supply chain optimization. Click here to find out more!

Case Study: Organic Marketing Platform for Data-Driven Growth

Organic marketing platforms helps PE-backed companies establish dominance in search results and target high-value customers through data-driven strategies. The platform tracks key growth metrics and optimizes campaigns to reach financial targets, delivering measurable ROI across portfolio companies. Click here to find out more!

Ready to transform your data analytics in private equity? Let CyberMedics help you eliminate fragmentation and unlock portfolio value. Schedule a consultation today.

Conclusion

Fragmented data systems cost private equity firms millions annually through concrete, measurable losses. Therefore, addressing these inefficiencies represents one of the highest-ROI initiatives available to PE leaders today.

Data silos drain resources across critical functions – from deal sourcing to portfolio management. Consequently, firms struggle with manual reconciliation, investor relations bottlenecks, compliance risks, and inconsistent KPIs. These challenges don’t merely create operational headaches; they fundamentally limit strategic agility and erode potential returns.

The evidence speaks for itself. Companies face over 15% in potential annual losses due to poor data quality, while deal teams waste countless hours on manual processes that unified systems could automate. Additionally, the compliance costs alone justify investment in centralized platforms that streamline reporting and reduce regulatory exposure.

Our CyberProcess™ methodology tackles these challenges head-on through systematic design, development, delivery, and impact measurement. Rather than proposing theoretical solutions, we’ve implemented real-world systems that deliver measurable results. Case studies demonstrate how our approval tracking systems reduce manual workloads by up to 35% while accelerating compliance cycles by 20-30%.

Private equity firms stand at a crossroads. Those clinging to fragmented data approaches will continue bleeding value, while firms embracing centralized analytics gain competitive advantages through faster decision-making and enhanced portfolio visibility. The difference becomes particularly apparent during market volatility, when rapid access to accurate data determines which firms can capitalize on fleeting opportunities.

Your portfolio companies deserve better than siloed systems that mask their true potential. CyberMedics helps you eliminate these barriers and unlock hidden value across your investments. Schedule a consultation today and discover how our tailored solutions can transform your data ecosystem into a strategic asset that drives superior returns.

Key Takeaways

Private equity firms are hemorrhaging millions due to fragmented data systems that create operational inefficiencies and missed opportunities across their portfolios.

- Fragmented data costs PE firms over 15% in annual losses through missed deals, operational inefficiencies, and delayed strategic decisions across portfolio companies.

- Manual reconciliation drains productivity as finance teams spend 4-5 hours daily on data hygiene instead of high-value analysis for investors and deal teams.

- Centralized data systems deliver measurable ROI by reducing manual workloads up to 35%, accelerating compliance cycles 20-30%, and cutting IT costs through consolidated vendor management.

- Real-time unified dashboards enable faster decision-making by providing instant visibility into portfolio KPIs, capital allocation, and emerging risks across all investments.

- Compliance risks multiply with disparate systems as spreadsheet-based operations create regulatory vulnerabilities that result in fines and audit deficiencies.

The solution lies in systematic data integration that transforms fragmented information into unified analytics platforms, enabling PE firms to make faster decisions, reduce operational costs, and unlock hidden portfolio value that directly impacts returns.

FAQs

Q1. How does fragmented data impact private equity firms financially?

Fragmented data can lead to potential annual losses of over 15% for private equity firms due to missed deal opportunities, operational inefficiencies, and delayed strategic decisions across portfolio companies.

Q2. What are the main challenges caused by fragmented data systems in private equity?

The main challenges include manual reconciliation draining productivity, investor relations bottlenecks, increased compliance risks, and inconsistent KPIs across portfolio companies, all of which hinder effective decision-making and strategic oversight.

Q3. How can centralized data systems benefit private equity firms?

Centralized data systems can reduce manual workloads by up to 35%, accelerate compliance cycles by 20-30%, provide real-time visibility into portfolio performance, and enable faster, more informed decision-making through unified dashboards and predictive analytics.

Q4. What is the CyberProcess™ and how does it address data fragmentation?

The CyberProcess™ is a four-phase methodology that systematically addresses data fragmentation through design, development, delivery, and impact measurement. It transforms fragmented systems into unified analytics platforms, delivering measurable improvements in operational efficiency and decision-making capabilities.

Q5. Why is addressing data fragmentation crucial for private equity firms?

Addressing data fragmentation is crucial because it directly impacts a firm’s ability to make timely strategic decisions, capitalize on opportunities, manage risks effectively, and ultimately drive superior returns across their investment portfolio.