Why Us Tariffs Are Forcing A Shift In Global Software Industry: Security Vs Cost

The software industry faces unprecedented challenges as the Trump administration announced a 10% baseline tariff on nearly all imports from 180 countries, effective April 2025. These measures are creating ripple effects throughout global technology markets, with JPMorgan reporting a 60% increase in the risk of a global recession following the announcement.

Consequently, software industry companies are recalibrating their strategies as economic forecasts darken. IDC has halved its projected global IT spending growth from 10% to approximately 5% in 2025 citing tariff impacts. Furthermore, new tariffs could potentially shrink U.S. GDP by between $149.3 billion and $438.4 billion, representing a decline of up to 1.45%. These economic pressures coincide with shifting priorities in the enterprise software industry, where 52% of buyers expect increased software spending in 2025, though 41% identified C-suite employees or CFOs as ultimately responsible for purchase decisions.

The rapidly changing landscape has particularly impacted the supply chain software industry, evidenced by a dramatic 306% increase in monthly traffic to Supply Chain & Logistics software categories from February to March 2025. This surge reflects growing demand for tools that manage global supply chain complexities amid geopolitical tensions. Additionally, heightened national security concerns are driving many organizations to reconsider offshore software development in favor of U.S.-based or nearshore alternatives, where cybersecurity and intellectual property protections benefit from stronger regulatory oversight.

Tariffs as a Catalyst for Software Industry Realignment

Tariffs have emerged as a powerful force reshaping the software industry landscape, despite software’s seemingly digital nature. The intricate connections between hardware and software create cascading effects throughout the technology ecosystem.

Hardware-Software Coupling and Cost Inflation

Industrial software solutions frequently operate as integrated hardware-software packages, with the software tightly coupled to physical components like programmable logic controllers and IoT devices—many imported from countries now subject to U.S. tariffs. As tariffs increase hardware costs, the overall solution becomes significantly less competitive. This coupling creates a ripple effect where higher capital expenditure on hardware reduces clients’ budgets for software services. Moreover, companies hesitant to invest in more expensive systems often delay modernization efforts, directly impacting growth for software vendors focused on Industry 4.0 solutions.

Impact on Cloud Infrastructure and Data Center Operations

Cloud providers face mounting challenges as infrastructure costs soar. With tariffs targeting critical components, major cloud providers including AWS, Microsoft Azure, and Google Cloud initially absorb these increases to maintain market share. However, as Forrester analyst Lee Sustar notes, “cloud providers face price shocks in their supply lines”. Microsoft’s planned $80 billion buildout of AI-oriented data centers will become significantly more expensive. Meanwhile, data center equipment costs have ballooned under tariffs, with HPE’s CFO acknowledging that “recent tariff announcements have created uncertainty for our industry”.

Software Licensing Challenges in Cross-Border Deployments

Cross-border software deployments face growing licensing complexities amid shifting import/export laws. Rising tariffs have disrupted long-standing supply relationships, making cross-border licensing agreements less viable, especially when pricing structures are impacted. Software companies now contend with added operational headaches since software isn’t tracked at customs like physical goods. This environment creates uncertainty in legal enforcement, making long-term IP protection and planning increasingly difficult. Consequently, companies must reevaluate supply chains through an IP lens, strengthening enforcement mechanisms against potential counterfeit risks in markets where legitimate products become more expensive.

Cybersecurity and IP Protection in Domestic Environments

Regulatory compliance has become a decisive factor in software development location decisions as national security concerns intensify. Companies increasingly recognize domestic environments offer stronger safeguards for sensitive digital assets and intellectual property.

Regulatory Oversight in U.S.-based Software Development Services

The Biden administration recently approved a secure software development attestation form, marking a significant advancement in software supply chain security. This form requires software producers working with the U.S. government to comply with standards for secure development practices, with non-compliance potentially resulting in agencies ceasing to use that software. The measures follow Executive Order 14028, implemented after the Sunburst supply chain attack to strengthen national cybersecurity. Notably, willfully false disclosures could violate criminal statutes, making attestation “a hard requirement enforced during procurement or renewal processes”.

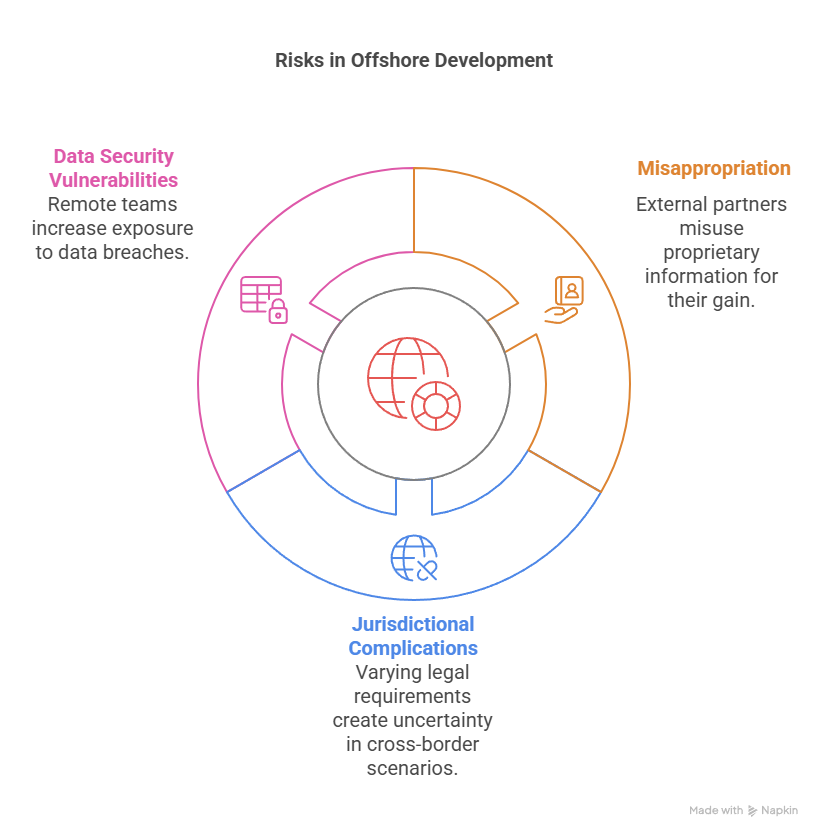

Intellectual Property Risks in Offshore Development

Intellectual property theft costs the United States between $180 billion and $540 billion annually, impacting over 45 million jobs. Offshore development introduces several critical risks:

Misappropriation and Theft: External partners may misuse proprietary information to develop competing products or sell intellectual assets to competitors

Jurisdictional Complications: Different countries maintain varying legal requirements for IP protection and enforcement, creating uncertainty in cross-border scenarios

Data Security Vulnerabilities: Remote teams increase potential exposure to data breaches, particularly concerning sensitive information

Certain industries face heightened vulnerability, chiefly technology, pharmaceuticals, manufacturing, and creative sectors.

Compliance Advantages in Nearshore Software Partnerships

Onshore development ensures stronger collaboration while maintaining rigorous compliance with local regulations. Industries handling sensitive data—healthcare, banking, and government—benefit substantially from domestic or nearshore partnerships. Essentially, projects involving sensitive user data or valuable intellectual property gain security advantages through teams obligated to comply with U.S. regulations. Separately, nearshore options offer cost efficiencies while maintaining proximity to U.S. regulatory frameworks, providing a middle-ground solution for companies seeking both compliance and economic benefits.

Strategic Advantage of U.S.-Based Vendors like CyberMedics

American-based software vendors are gaining strategic advantages as geopolitical uncertainties reshape the software industry landscape. CyberMedics represents a growing segment of domestic providers whose value proposition extends beyond mere technical capabilities.

Operational Transparency and Customization Capabilities

Operational transparency has become a critical factor in business growth, with companies prioritizing it as a key business driver. Indeed, transparent operations create a healthy company culture by establishing a “single source of truth” that unifies teams around common goals. CyberMedics, exemplifies this approach through our CyberProcess™, which ensures clients receive precisely tailored software solutions. This methodology helps teams understand their workflows, identify improvement opportunities, and develop adaptable custom software. Subsequently, this transparency in development processes allows for better alignment between vendor capabilities and client needs, thus creating long-term partnerships rather than transactional relationships.

Reduced Risk from Geopolitical Volatility

The global IT operating model faces unprecedented pressure from geopolitical developments. Specifically, over 70% of countries now have their own data protection and privacy laws, causing significant fragmentation in technology operations. Additionally, projected annual damage from cyberattacks is expected to reach approximately $10.50 trillion during 2025—a 300% increase from 2015 levels. Accordingly, businesses must rebalance their operations globally to address current and potential issues, with options including reshoring operations to lower-risk regions and localizing global operations. The Russia-Ukraine war and Israel-Hamas conflict further illustrate how regional conflicts can disrupt international stability, markets, and supply chains.

Alignment with U.S. Regulatory and Security Standards

U.S.-based vendors provide inherent advantages regarding regulatory compliance and security. Hence, forward-thinking CIOs are proactively planning interventions based on risk scenarios rather than reacting after problems emerge. Rather than creating country-specific strategies that might “squeeze the balloon” and push risks elsewhere, domestic providers offer consistent alignment with U.S. standards. This alignment becomes particularly valuable as industrial and trade policies increasingly favor local providers, thereby raising complexity and costs for IT procurement from foreign sources.

Shifting Buyer Priorities in the Enterprise Software Industry

Enterprise buyers are fundamentally changing their software procurement strategies in response to economic pressures and security concerns. This shift reflects broader changes in how organizations evaluate and select technology partners in an increasingly complex global landscape.

CFO-Led Procurement and ROI Expectations

Financial executives now exert unprecedented influence over software purchasing decisions. In fact, 41% of organizations identify C-suite employees or CFOs as ultimately responsible for purchase decisions. This evolution stems from traditional procurement models being upended by data-driven approaches to unlock value. CFOs typically expect procurement to deliver year-over-year cost reductions of 3% or more, creating pressure to demonstrate measurable returns. As a result, procurement is evolving from a cost center into a strategic enabler that drives profitability and improves cash flow.

Increased Demand for Secure Supply Chain Software

Security considerations increasingly dominate software selection criteria. According to recent research, attacks against the software supply chain increased by 1,300% last year. The 2024 Verizon Data Breach Investigations Report indicated breaches stemming from third-party software development organizations contributed to 15% of over 10,000 documented data breaches—a 68% jump from the previous year. In response, organizations are prioritizing software with robust security credentials, alongside the federal government’s introduction of initiatives like the Secure by Demand framework.

Preference for Vendors with Domestic Infrastructure

The Build America Buy America Act has established domestic content procurement preferences for all federal infrastructure projects, creating ripple effects throughout private sector purchasing. Post-pandemic, 85% of organizations struggle to achieve strategic sustainability goals due to difficulty sourcing appropriate suppliers. Simultaneously, vendor selection criteria now include ethical business practices and domestic infrastructure considerations. This trend corresponds with cloud adoption continuing to grow rapidly—89% of organizations now leverage multicloud strategies—with preference increasingly given to providers aligned with domestic regulatory frameworks.

Conclusion

The global software industry stands at a critical inflection point as tariffs, geopolitical tensions, and security concerns reshape development strategies worldwide. Consequently, businesses must now prioritize long-term security over short-term cost savings when selecting software partners. Though offshore development once offered compelling economic advantages, these benefits diminish significantly when weighed against mounting regulatory complexities, intellectual property risks, and supply chain vulnerabilities.

Financial executives certainly recognize this shifting calculus. Their growing influence over procurement decisions reflects a deeper understanding that software security represents both an operational necessity and a competitive advantage. Similarly, enterprises increasingly value supply chain transparency, regulatory compliance, and intellectual property protection—areas where domestic providers excel. Therefore, U.S.-based vendors gain substantial strategic advantages through their alignment with domestic regulatory frameworks and security standards.

The economic impact remains measurable and significant. Despite initial cost differences, companies ultimately save resources by avoiding the complicated legal entanglements, security remediation, and compliance penalties that frequently accompany offshore development relationships. Additionally, the ripple effects of tariffs throughout hardware-software ecosystems create unexpected cost increases that undermine the traditional offshore value proposition.

Looking to secure your software development strategy in a volatile global market? CyberMedics delivers U.S.-based, customizable software solutions with built-in IP protection, regulatory compliance, and operational transparency. Our approach addresses the fundamental challenges organizations face when balancing innovation against security concerns.

FAQs

Q1. How are tariffs impacting the software industry?

Tariffs are indirectly affecting the software industry by increasing hardware costs, disrupting supply chains, and creating economic uncertainty. This leads to tighter budgets, longer sales cycles, and increased scrutiny on software purchases by businesses.

Q2. Why are U.S.-based software vendors gaining an advantage?

U.S.-based vendors are benefiting from increased demand for operational transparency, reduced geopolitical risks, and better alignment with U.S. regulatory and security standards. This makes them more attractive to businesses prioritizing security and compliance.

Q3. How are enterprise software buying priorities changing?

Enterprise buyers are increasingly prioritizing security, regulatory compliance, and domestic infrastructure when selecting software vendors. CFOs and C-suite executives are now more involved in purchase decisions, focusing on measurable ROI and cost reduction.

Q4. What role does cybersecurity play in software development location decisions?

Cybersecurity has become a crucial factor in choosing software development locations. U.S.-based development offers stronger regulatory oversight, better intellectual property protection, and reduced risks associated with offshore development, making it increasingly attractive to businesses.

Q5. How are tariffs affecting cloud infrastructure and data center operations?

Tariffs are significantly impacting cloud providers and data center operations by increasing costs for critical components and infrastructure. This is leading to price pressures and potential delays in expansion plans, which could affect the broader software industry that relies on cloud services.